AO - 100% Community TGE

gm

Recently, I have been studying about Tokenomics. I came across a "Fair Launch" by AO during my study. AO is the Hyper Parallel Computational layer built on top of Arweave, and a few days back, they had their Token Generate Event (TGE).

The exciting part about AO Tokenomics is its stakeholders.

The stakeholders include ONLY THE COMMUNITY. However, the team is confident that the Ecosystem Development will go smoothly.

I am intrigued by how this will work for the core AO dev team, ecosystem projects on AO, for stakeholders in Arweave, and for general community members. So, I sat one night and read the latest draft on AO.

Here are some of my critical findings about AO tokenomics. I hope you find something useful.

LFG 💪🏻

Total Supply

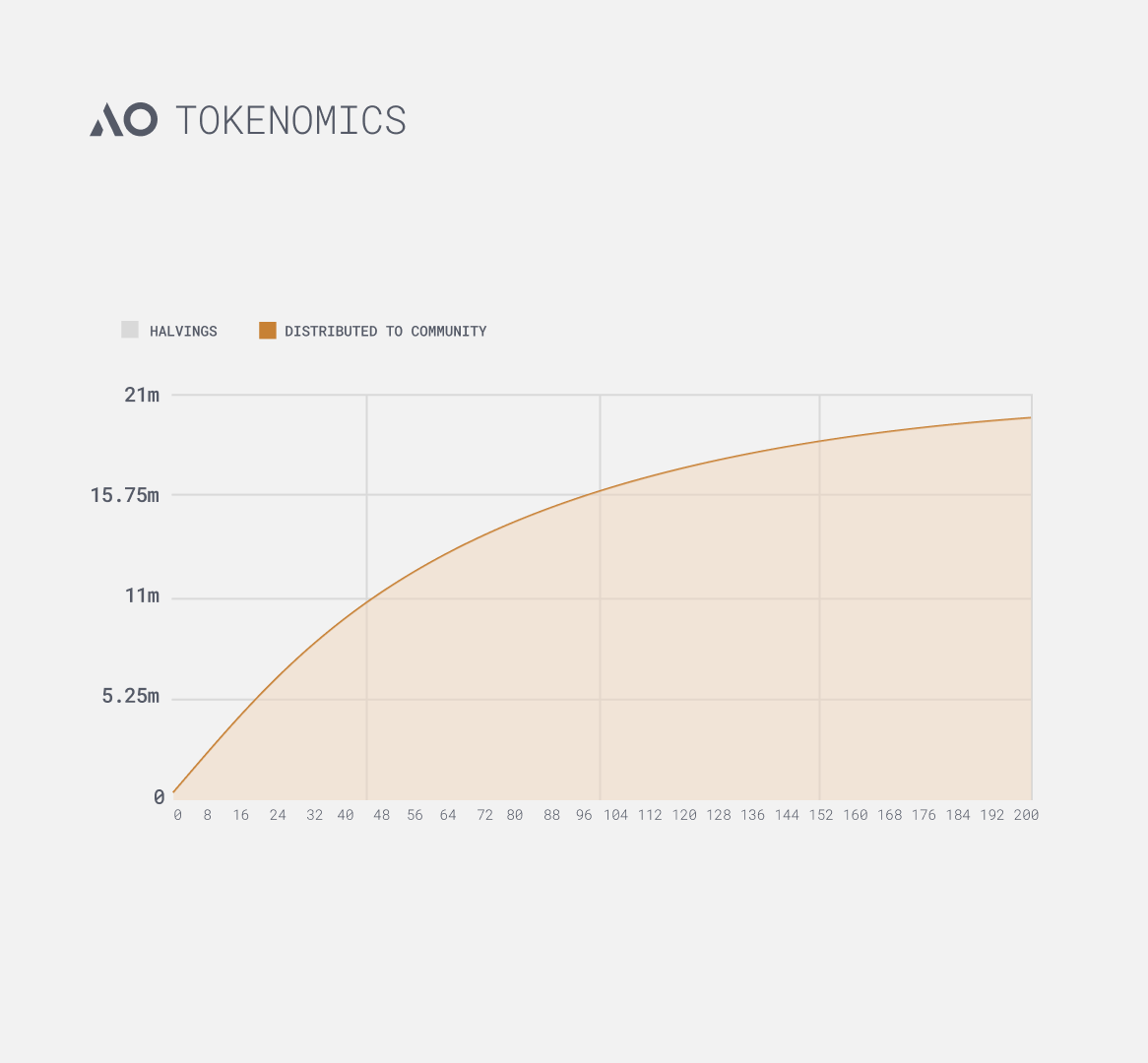

Fundamentals of Bitcoin inspire AO Tokenomics.

There can only be a 21M supply of AO tokens like Bitcoin. These tokens will be minted over the years with 4 year smooth-halving.

Circulating Supply

The method of circulation is genuinely fascinating.

The AO tokens were minted every 5 minutes from the launch of the AO network on February 27th, 2024.

Minting new tokens every 5 minutes accumulated to 1.425% monthly of the remaining supply. Minting like this is equivalent to 4 years of halving like Bitcoin, but instead of doing it abruptly, it's done in a flow.

A small visual to get it into the perspective:

Distribution

AO is built on Arweave, the permanent data storage network, which provides economic security to AO, the computation layer, and permanent storage and validation for all the messages passed on AO in a truly decentralised manner. This is only possible because of $AR, the native token on Arweave.

This brings two types of participants who can earn AO during the minting period.

$AR Holders

Users who bridge the assets

$AR Holders

As mentioned above, the AO was minted from the network launch on 27 February. In four months, this accumulated to more than 1M $AO, distributed proportionately among AR holders.

Further, to continue incentivising the Arweave Community (including miners), 1/3rd of the newly minted AO will be distributed to $AR holders.

Bridged Assets

Users can bridge assets from other networks to AO networks to contribute to the economic security of their network.

Users are highly incentivised to bridge their assets from other networks to AO.

First, they can use (not right now) the bridged assets in the wide varieties of applications on AO and

Second, they will mint AO.

After bridging assets like stETH, users will earn 2/3rd of newly minted AO tokens proportionately.

The bridging is divided into phases.

Currently, phase 1 is in process, during which you can deposit stETH from Ethereum Mainnet to the AO network and mint AO but cannot use stETH in the AO Network.

In the coming phases, the stETH will be available within the AO Network while minting AO for the users.

Ecosystem Growth

The above sections explain how the AO will be distributed to 100% of the community.

This raises the question of how the development of different projects on AO and the AO itself will be sustained. The answer is Bridged Assets.

As per the AO's latest paper, ecosystem growth is divided into two parts:

Permissionless Ecosystem Funding

Permaweb Ecosystem Development Guild (PEDG)

Permissionless Ecosystem Funding

The idea of permissionless ecosystem funding is really simple. The community will support the projects in their development and provide potential revenue.

Community members can interact with applications using their bridged assets. When the team receives these bridged assets, projects can earn AO with the proportionate liquidity they can gather from the community, providing the team with sufficient funds for development. This makes the whole process permissionless and removes the requirement for grants to keep building.

Permaweb Ecosystem Development Guild

The PEDG includes six core teams that contribute to the development and maintenance of AO. These teams are funded by the native yield of the bridged assets, like stETH on Ethereum Mainnet.

Thanks for reading!

Any feedback is appreciated 🙌🏻

Keep Building (🧱,🚀)

megabyte

megabyte